unrealized capital gains tax meaning

Those gains will not become locked-in until you decide to sell at. An unrealized gain refers to the potential profit you could make from selling your investment.

Biden Expresses Support For Annual Tax On Billionaires Unrealized Gains Wsj

If you dont sell the asset you have an unrealized capital gain which isnt subject to taxes.

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. In summary unrealized gains are simply a snapshot in time of how your stockportfolio is performing. Unrealized gains and losses are also commonly known as paper profits. Capital gains meaning earnings from selling an asset for more than you bought it are taxable under federal tax law.

An unrealized gain is an increase in your investments value that you have not captured by selling the investment. Depending on the holding period it will be. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

In addition to taxing unrealized gains at death the AFP would raise the top marginal capital gains tax rate for taxpayers earning over 1 million to 434 percent when including the. The Problems With an Unrealized Capital Gains Tax. The capital gains tax only applies to realized capital gains.

With respect to each Security held by the Partnership on the last day of an Interim Period the difference between i the value of the Security on such. Ron Wyden D-Oregon announced on Tuesday that he is working on a mark-to-market system that would tax unrealized capital gains on assets owned by millionaires and. The IRS offers a.

To increase their effective tax rate to. Define Unrealized Capital Gains or Losses. Unrealized losses occur when an investment you hold has lost money but you dont.

The new proposal would tax unrealized capital gains meaning the wealthy would no longer be able to defer tax payments on gains made each year. Key Takeaways Net unrealized appreciation NUA is the difference between the original cost basis and current market value of shares of employer stock. If the proposal were passed.

Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant reasons why. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase. Realized gains are often subject to capital gains tax.

Capital gain is an increase in the value of a capital asset investment or real estate that gives it a higher worth than the purchase price. A gain or loss on an investment is realized when it is sold. Unrealized gains are not taxed until you sell the investment.

An unrealized loss is a decrease in the value of an ongoing investment. Gains or losses are said to be realized when a stock or other investment that you own is actually sold. A realized gain is when an investment is sold for a higher price than it was purchased.

In other words if an asset is projected to make money but you dont cash in on that. The gain is not realized until the asset is. Capital gains are taxed and capital losses may be.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

State Taxes On Capital Gains Center On Budget And Policy Priorities

Why Unrealized Gains Losses Isn T The Best Way To Look At Performance Merriman

What Are Capital Gains Taxes And How Could They Be Reformed

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Biden Budget Taxing Unrealized Capital Gains Won T Work National Review

Capital Gains Tax Definition And How To Calculate It Pointcard

Crypto Tax Unrealized Gains Explained Koinly

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

No U S Won T Tax Your Unrealized Capital Gains Alexandria

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

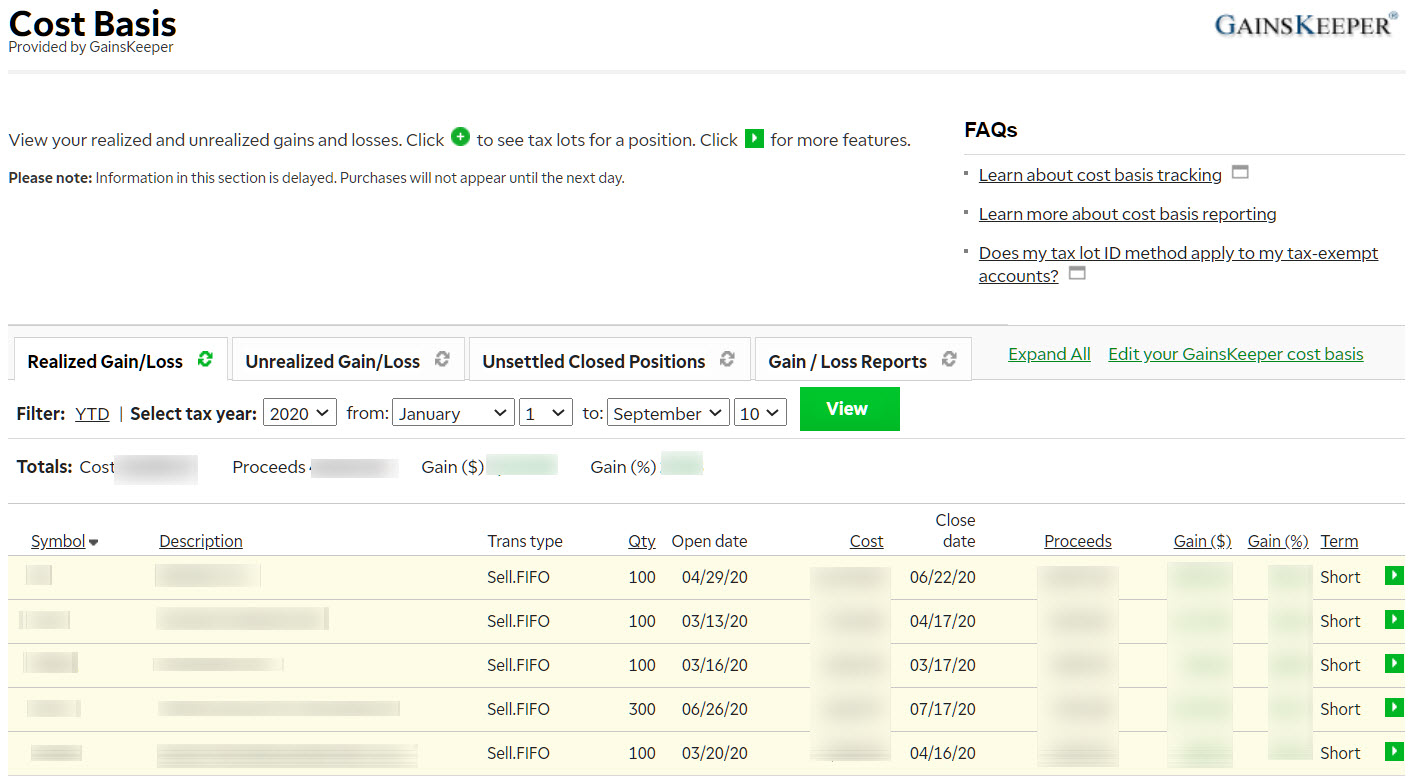

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

Capital Gains Tax Definition Rates Calculation

Crypto Tax Unrealized Gains Explained Koinly

Capital Gains Tax Hike And More May Come Just After Labor Day

Not Gaining Traction Biden Administration S Proposed Tax On Unrealized Capital Gains Comes To A Halt

Unrealized Capital Gains Tax What Is It Churchill

Ron Wyden S Capital Gains Tax Proposal Is Insane National Review